Energy Transition, Financial Markets and EU Interventionism: Lessons from the Ukraine Crisis

Abstract

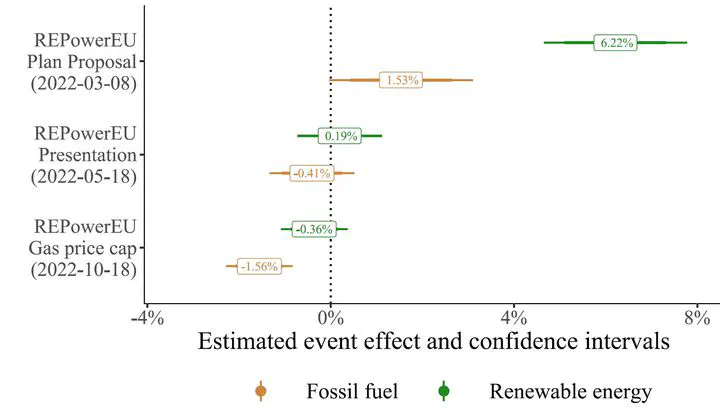

A successful energy transition requires the reallocation of private capital away from fossil fuel assets to greener alternatives. This transition is typically hindered by investors’ focus on today’s returns. In times of crisis, however, credible and unambiguous political signals about the future profitability of green industries can steer investments towards low-carbon assets. Drawing on European Union interventions during the onset of the Russian invasion of Ukraine, we present an event study of daily stock market returns following the most salient policy announcements by the European Commission in 2022. Our analysis shows that markets for shares of EU-based energy firms were initially prepared to move capital to cleaner companies, suggesting support for the clean energy transition. However, the short-lived distributional effects materialized only for announcements that could unmistakably be understood as unwavering commitments to the EU’s green renewal, while more ambiguous announcements did not have the same distributional implications. Our findings emphasize that repeated and unambiguous political signals during crisis episodes can create favorable market conditions, at least in the short-term, to support capital reallocation towards greener stocks.

Type

Publication

Political Science Research & Methods